As an Amazon Associate we earn from qualifying purchases.

John in NJ asks:

John in NJ asks:

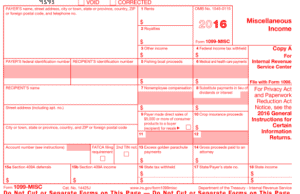

I am a one person photographer. I have a client, the first time in 6 years is wanting to give me a 1099 for services. What are the requirements for photographers with regards to 1099s?

Here is the IRS page that has instructions for the 1099-MISC. In summary, in the, US anyone that is paid $600 or more in a year to perform services who is not your employee is required to receive a 1099-Misc from you. So, any of your clients that you do a bunch of shoots for (that add up to over $600) should be filing a 1099-Misc with the IRS and sending you a copy. It is their responsibility to file the 1099-Misc with the IRS but it wouldn't hurt to remind them.

If you collect payment from clients via PayPal, Square, or some other payment processing service that amount that comes through the payment processing service should not be included in any other 1099-Misc because the payment processing company will be giving you a 1099-K that documents the income that comes through them.

Of course, the idea of all this is to allow the IRS to make sure they know about all of your income.

But if you are shooting under an LLC, would it still be a requirement? I think this is just for people shooting under their own name - but I am by no means a lawyer. Any lawyers in the house that can confirm?

I'm not a lawyer either but my company (PFRE Media LLC) is required by the IRS to send a 1099-Misc to anyone that I pay over $600/yr to.

Hmm. Of the 15+ agents I've worked with over the last few years, have only received them from 2. Hopefully I'm ok!

If you are charging sales tax based on products you sell including the images, videos and other such electronic pieces of media, then the agents do not have to provide 1099 info any more than they would have to provide 1099 for a car they bought from dealership or the gas station they buy gas from. Brides do not send the IRS 1099 for their wedding pictures nor do wedding photographers provide their info to brides for them to provide 1099 to the IRS.

The difference is if you are providing service for hire or selling a product. I sell products. I charge sales tax for everything I sell. The State has told me I sell products. The agents buy products. I do not provide services for hire.

I provide detailed lists of all products they have purchased from me to any that have not saved their receipts.

Over the past decade plus, I have only had one agent request a 1099 from me. More common is when you do work for larger companies with internal accounting divisions, they are constantly reducing their chances an audit will find issues. We keep a signed 1099 on file to easily and quickly be able to send at a client's request.

This issue segues well into liability and finance. Most people don't feel comfortable sending any form with their social security number imprinted on it. And we all should want protection from our personal assets. Securing a LLC for your huge real estate photography company or one-man band show will provide protection from your personal assets. Plus when anybody requests a 1099 from you, your Employer Identification Number (EIN) will be used instead of a social security number.

In the end, it's not a major issue when a client requests a 1099 from you. It only seems like something big when we aren't educated on the "why". I personally don't take offense to a 1099 request, it actually tells me they are using an accountant that understands tax law and liabilities. Now go get your LLC or other business license and move onto ways to improve your systems and efficiency.

@Matthew It sounds like you're talking about a W-9 instead of a 1099.

The first week of January I send each client an email containing a summary of payments they have made to me for the year. Because I use Poctketsuite it's a simple export and a matter creating a mail merge that inserts the payment information and emails it out. Takes less then a hour and puts me in front of my client again. I remind them that if they paid me over $600 to 1099 me, offer a W-9, and ask if they want to be added as an additional insured on my general lability insurance.

Results: I get a bunch of simple "thank you" replies and people who might have lost track or forgotten about me get a reminder. And importantly my clients know that I am an insured professional who understands what they need to operate a business. How many 1099s did I get from the 380 emails I sent out last year? 12.

Who cares? If you claim everything and pay the proper taxes you've already claimed that income for that 1099 and it's not going to change your tax burden. On the other hand, you're not claiming any income and paying no taxes and then I see your concern (probably writing off the expenses and equipment if I had to guess) and don't really feel sorry for you. FYI we send to any person or entity we paid more than $600 excluding INC.

@ Mathew - Deno is correct. You send a W-9 to a client so that they can fill out and send you a 1099-Misc if required. Also, sole proprietors are allowed to get an EIN. Read page 4 of IRS Publication 583. https://www.irs.gov/pub/irs-pdf/p583.pdf

My EA (tax guy) looks at the income reports that I give him. He doesn't take any data off of the 1099 forms because all of my business income is accounted for in my reports. However, I verify that the income I report from a client reconciles with the 1099 the client sends me. If I was ever audited, I'm sure the IRS would look to verify that as well. If a client doesn't issue a 1099 and they were supposed to, that is on them. If you don't report the income that you don't have a 1099 for, that is on you.

Yeah Jason is right. In the state of Ohio (my state), you do not have to charge sales tax if your product is digital and delivered digitally. If you print it or deliver the end product on a thumb drive (per say), then you have to charge sales tax.

If you invoice the client and provide them with a reciept upon payment, then they can not 1099 you, as they already have a sales reciept to write off as an expense on their taxes.

As regards the comment about W-9s, "Securing a LLC for your huge real estate photography company or one-man band show will provide protection from your personal assets. Plus when anybody requests a 1099 [W-9] from you, your Employer Identification Number (EIN) will be used instead of a social security number."

Actually, I disagree with this statement. A LLC is a 'disregarded entity' meaning the owner's SSN is still required. Will you get boinked over it, I've never heard of it, but the EIN for a single-owner LLC is not correct.

I lose no sleep if anyone neglects to send me a 1099-MISC. The onus is on them and it has no bearing on how I do my accounting. As Larry notes, it's all about the IRS trying to make sure it knows all it can about everyone.

As per the W-9, most of my commercial clients ask for, primarily, as a means of helping prove I am not their employee. A few times they've also required I submit a copy of my insurance policy as well. That I decline. Fortunately, my provider gives me a 1-page document for that purpose.